The Shift in Amazon’s Vendor Central Dynamics

VC has long been one of Amazon’s prized assets, enjoying various perks, traffic support, and favorable policies. Thanks to its cost advantages, VC even dominates some categories. VC accounts can easily reach millions, and there are reports of VC accounts with zero commission achieving transaction amounts over 2 million—which is enough to buy a nice house in Changsha.

On the other hand, many sellers steer clear of VC because product listings are often maliciously altered or overloaded, leading to suspensions. But then the tide suddenly turned.

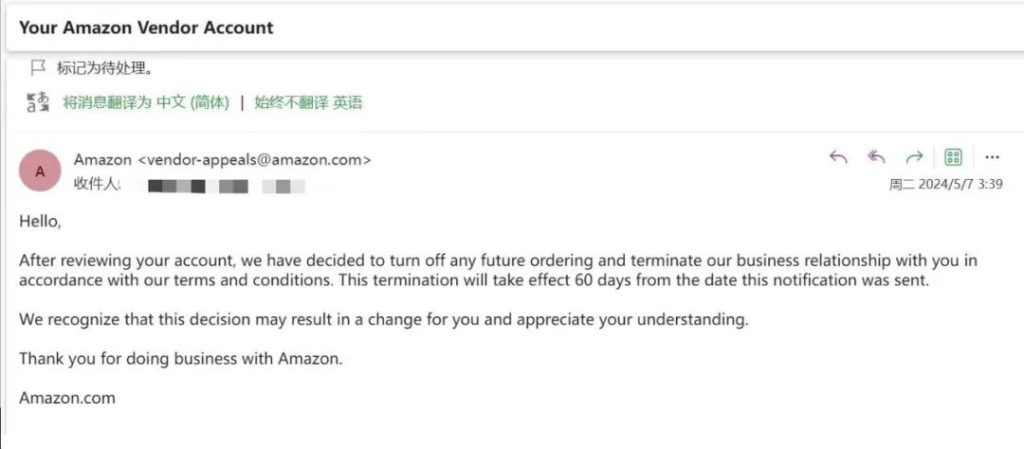

Since March 2024, large numbers of VC accounts have been closed daily. Members in the Cross Border Intelligence VC group have also been sharing messages about store closures and requests for account reactivation. Why are VC accounts, once known for safety and stability, now facing massive liquidation? After analyzing numerous closed stores, we have identified several key factors:

──────────────────────────────

New Risk Management Framework

VC has introduced a new risk control system. The risk control team now wields significant authority and can manually close stores based on risk levels. The primary cause for store closures by this team is fraud. For example, repeatedly listing the same product at inconsistent prices can be seen as price fraud.

Another major factor for closure is brand association—if one brand is shut down for risk reasons, all VC accounts associated with the same listing will be affected.

Additionally, violations of operational rules can trigger closures. In one notable case, a large store was closed for violating variant rules.

VC stores engaging in fake orders are marked for order abuse and fraud, almost impossible to recover through appeals.

──────────────────────────────

Stricter Financial Metrics

Many VC projects are operating at a loss due to unhealthy stock buildup or suppliers offering purchase prices too low to cover Amazon’s costs. Every March, Amazon reviews the previous fiscal year’s performance and will exit accounts that have incurred losses. This includes those failing to meet NET PPM and overall store contribution margin (CM) benchmarks.

──────────────────────────────

Tighter Store Performance Evaluations

First, Amazon is clearing out numerous inactive zombie accounts by canceling PO and DF agreements for VC accounts that have not operated for a long time.

Second, poor order delivery and logistics performance—as well as unhealthy stock remaining for over 120 days—negatively impact account health.

──────────────────────────────

Cross Border Observers Say:

VC sellers are now proclaiming that the VC era is over and that the future no longer belongs to VC.

Amazon’s original intent for VC was to allow high-quality factories onto the platform, eliminating middlemen to provide sellers with lower prices, higher quality, and a better experience.

However, the factories that joined did not operate their stores, leading to years of poor performance, while most active VC operators turned out to be pure trading companies, overloaded with brands, spanning various categories, and filled with gimmicks.

In May, senior management held a meeting to reassess and reform the VC project!

Amazon VC must undergo a process of survival of the fittest—quality over quantity!

The wheels of time roll on and will not suddenly stop. After the tide has washed the sand, only the higher quality and more dedicated product suppliers, who value market fundamentals and respect the interests of both Amazon and buyers and pursue win–win strategies, will remain.

The golden age of VC is not over; a diamond era is on the horizon.

Incredible that a system once adored for its perks is now facing mass closures.

A real wake-up call for sellers who relied on the old system’s perks.

This purge might pave the way for more dedicated, quality suppliers in the future.

It’s like the end of an era, but perhaps the start of something even better.

Operational rule violations and fake orders are now a dealbreaker.

A diamond era for VC might emerge from this rigorous cleanup of the platform.

For sellers, the unpredictability of account closures is a major headache.

The reassessment of VC could lead to a more sustainable marketplace overall.

It’s crazy how strict financial metrics can force out underperforming accounts overnight.

Stricter performance evaluations are clearly filtering out the noise.

The new risk control framework seems to be shaking things up big time.

Every day, more VC accounts are disappearing—talk about a shakeup.

The emphasis on eliminating fraud and price manipulation shows Amazon’s tightening grip.