As a global powerhouse in both e-commerce and cloud computing, every financial report from Amazon sends ripples throughout the industry.

Just yesterday, the company delivered another impressive performance, showcasing its resilience amid a complex economic landscape while also hinting at future trends in cross-border e-commerce, cloud computing, and artificial intelligence.

Quick Overview of Key Figures

Growth Across the Board, with International Business Turning Profitable

Part 1: Explosive Growth in Revenue and Profit

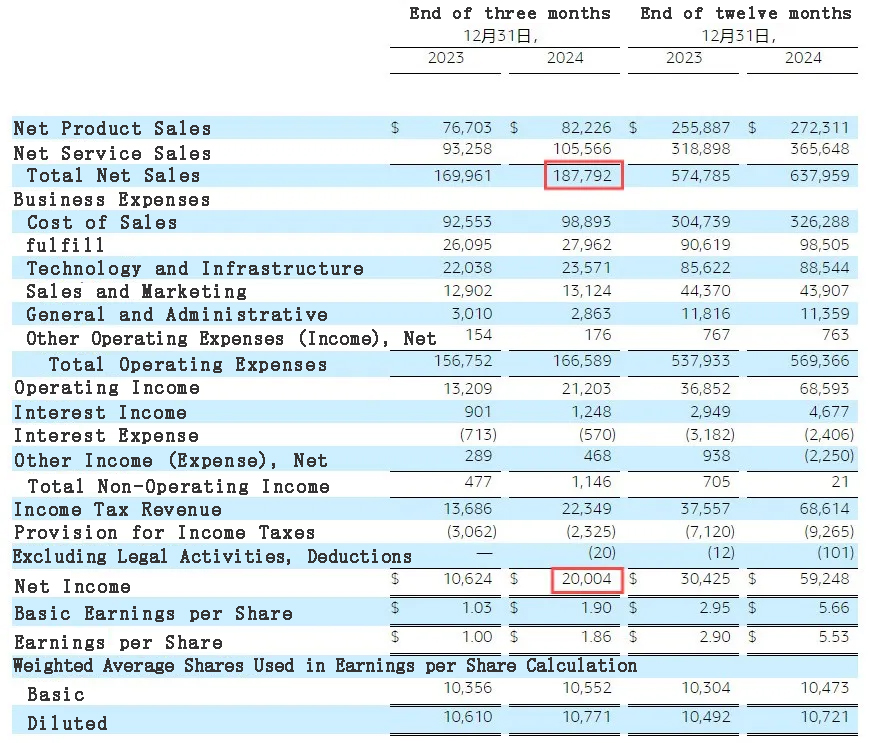

Revenue and Profit Skyrocket

- Global Net Sales:

- Q4 reached $187.8 billion (up 10% YoY)

- Full-year sales totaled $638 billion (up 11% YoY)

- Net Profit:

- Q4 profit hit $20 billion (up 88% YoY)

- Full-year profit reached $59.2 billion (up 95% YoY)

- Earnings per share surged from $2.90 to $5.53

- Cash Flow:

- Operating cash flow increased by 36% to $115.9 billion

- Free cash flow climbed to $38.2 billion, further solidifying its financial reserves

Image: Amazon Q4 2024 Financial Report (Source: Amazon)

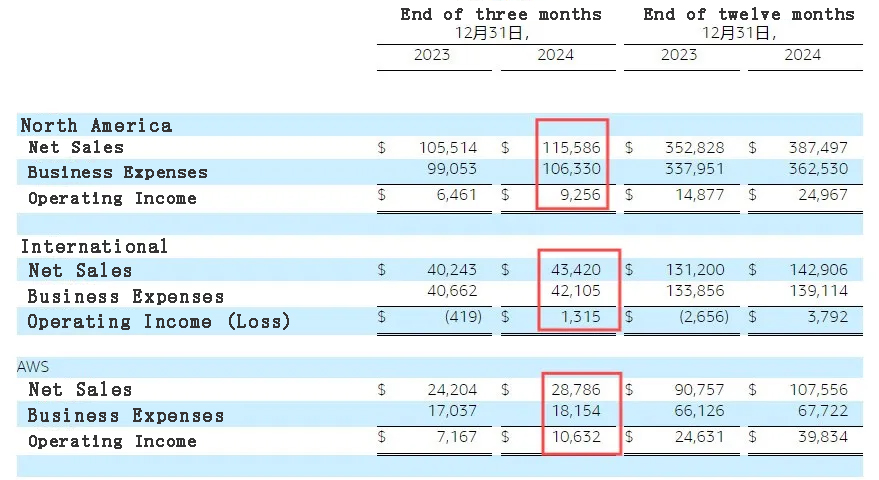

Part 2: Steady Progress Across Three Major Business Segments

North America:

- Sales reached $115.6 billion (up 10%)

- Operating profit was $9.3 billion (up 43%)

International Markets:

- Sales amounted to $43.4 billion (up 8%)

- Achieved a record single-quarter operating profit of $1.3 billion (in contrast to a $400 million loss in the same period last year), making this segment the standout performer

AWS Cloud Computing:

- Sales hit $28.8 billion (up 19%)

- Operating profit soared to $10.6 billion (up 48%), cementing its status as the global leader in cloud services

Image: Amazon Q4 2024 Financial Report (Source: Amazon)

Part 3: Key Growth Drivers

Prime Membership Services:

- Global same-day/next-day delivery package volumes surged 65% YoY

- Black Friday and Cyber Monday sales reached record highs

- Contribution from independent sellers hit an all-time high

Advertising Business:

- Revenue reached $17.3 billion (up 18%)

- For eight consecutive years, Amazon has been recognized as “America’s Lowest-Priced Retailer,” maintaining its competitive edge

Content Ecosystem:

- The Prime Video original film Red One attracted 50 million viewers within four days

- Thursday night football games averaged 13.2 million viewers (+11%)

International Turnaround: Three Key Factors Behind the Shift from Losses to Profit

In the past, Amazon’s international business was hampered by high investments and fierce regional competition. However, turning profitable in Q4 2024 with an operating profit of $1.3 billion reflects significant strategic efforts:

- Localized Supply Chain Upgrades:

In emerging markets such as Spain and Southeast Asia, Amazon enhanced its regional logistics network to cut delivery times by 30% and launched the “Amazon Haul” budget section to better match local demand. Additionally, in response to Europe’s energy crisis, the company initiated renewable energy-powered warehousing to reduce operating costs. - Empowering Cross-Border Sellers:

New features like “Prompt Caching” (to reduce AI inference costs) and “S3 Metadata” (for automatic data tagging) have enabled small and medium-sized sellers to optimize operational efficiency. Q4 revenue from third-party seller services reached $47.5 billion (up 9%), accounting for 62% of international sales. - Hedging Geopolitical Risks:

The adverse impact of currency fluctuations on revenue dropped from $900 million in 2023 to $210 million, as Amazon mitigated pressures during a strong dollar cycle through multi-currency settlements and regional pricing strategies.

AWS: Cloud Computing + AI – Setting the Standard for Next-Generation Technology

Despite fierce competition from Microsoft Azure and Google Cloud, AWS solidified its leadership with a 19% growth rate—far surpassing the industry average. Its core competencies include:

1. In-House AI Chips and Models

- Trainium2 Chip:

Launched EC2 instances that offer 30-40% better cost-performance than traditional GPUs, in collaboration with Anthropic to build the world’s largest AI computing cluster, “Project Rainier.” - Amazon Nova:

An internally developed suite of large models that supports low-latency, cost-effective inference, already adopted by thousands of enterprises including Deloitte and SAP.

2. Innovation in Enterprise-Level Services

- Bedrock Platform:

Introduced over 100 new third-party models along with features like “Model Distillation” and “Intelligent Routing,” reducing customer inference costs by 25%. - Aurora DSQL Database:

Delivered four times faster read/write speeds and supported 99.999% multi-region availability, attracting heavyweight clients such as PayPal and the U.S. Army.

3. Global Infrastructure Expansion

- Opened new data centers in the Asia-Pacific region (Thailand) and Mexico, increasing global availability zones to 105 to meet the digital demands of emerging markets.

Challenges and Future: Can Growth Sustain in 2025?

Despite the impressive results, the report also outlines several risks:

- Economic Uncertainty:

Global inflation and weakened consumer spending could temper Q1 2025 growth, with projected sales of $151-155.5 billion (up 5-9% YoY). - Regulatory Pressure:

Ongoing antitrust investigations in the US and Europe, along with new digital tax policies, may drive up compliance costs. - Intensifying Technological Competition:

Rivals like OpenAI and Microsoft’s Copilot are rapidly advancing in the enterprise AI space.

CEO Andy Jassy’s Strategic Anchors:

- Cost Optimization:

By automating warehousing and deploying AI-driven scheduling, Amazon plans to trim its workforce by 2% (approximately 30,000 employees) over the year, keeping its total headcount around 1.55 million. - Long-Term Technology Investments:

In 2024, the company’s R&D expenditure exceeded $52 billion, focusing on quantum computing, biotechnology, and space logistics.

Looking Ahead

In 2024, Amazon stands not only as an e-commerce leader and cloud computing titan but also as a builder of global technological infrastructure. The underlying strategy is clear: leverage technological innovation to reduce costs and boost efficiency while diversifying risk through global expansion.

The rise in Amazon’s same-day delivery share underscores that exceptional fulfillment capability is essential for customer retention. Third-party sellers are encouraged to embrace tools like Bedrock and SageMaker to lower the barriers to data analysis and marketing. With e-commerce penetration in Southeast Asia and Latin America below 10%, Amazon’s regional strategy offers a compelling blueprint for success.

For cross-border e-commerce professionals, staying abreast of platform upgrades, deeply engaging in regional markets, and harnessing AI will be the key to thriving over the next decade.