How New U.S. Policies Are Reshaping Cross-Border E-Commerce

1. End of the De Minimis Era

According to the latest information on the White House website, the Trump administration has decided to officially cancel the de minimis policy for goods valued under $800, effective from 12:01 AM Eastern Time on May 2, 2025. This decision will take place once the U.S. Secretary of Commerce notifies that a “sufficient system has been established to collect tariff revenue.”

For years, many cross-border e-commerce sellers have split shipments into small packages, each valued at less than $800, to benefit from the tariff exemption. Logistics companies have coordinated to distribute shipments to different recipients at nearby addresses, effectively dodging tariffs. With the cancellation of this exemption, all postal packages from China will no longer qualify for the simplified T86 clearance process; instead, they must now go through the more complex T11 or T01 procedures and pay the full tariffs.

A condition was added to this executive order: the cancellation of the tariff exemption is contingent upon the Secretary of Commerce confirming that the customs system is fully prepared to collect tariff revenue. This precaution was taken after an earlier attempt in February—when Trump abruptly canceled the de minimis exemption only to reinstate it shortly after, due to Customs not being ready. With over a billion small packages previously using the T86 process, shifting to T11/T01 procedures is expected to cause significant delays and congestion at U.S. customs, potentially prompting further adjustments if readiness issues persist. This marks the likely end of the era of tariff-free cross-border e-commerce.

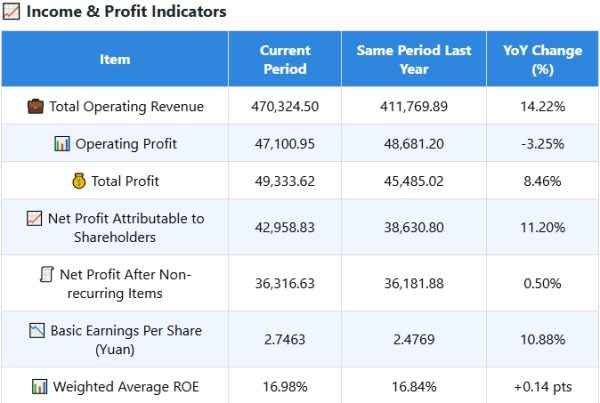

2. New Round of Tariff Increases

On April 2, President Trump announced additional “reciprocal tariffs” aimed at trade partners. Two measures were introduced:

- A minimum tariff of 10% for all trade partners, effective from April 5 Eastern Time.

- Higher tariffs for certain countries—including China, Japan, and Vietnam—set to take effect from April 9 Eastern Time.

These new tariffs add further pressure to the cross-border e-commerce and export trade sectors.

3. Facing the Pressure: A Transformation in Cross-Border E-Commerce

Many cross-border logistics providers had sensed that changes were coming and began suspending shipments to the U.S. even before an official announcement. They warned that with the cancellation of the T86 clearance process, the cost of processing shipments under the new system would inevitably rise, and billing would follow a new pricing structure.

This shift is set to drive significant changes in the logistics and warehousing models for cross-border e-commerce. Over the next three years, it is expected that more Chinese e-commerce companies will establish local warehouses in the United States to mitigate these costs. For many sellers, local storage and fulfillment become not only a countermeasure to the new tariff policies but also a necessity for business growth.

E-commerce sellers will likely face a period of adjustment—reassessing product selections and switching strategies. They must calculate the detailed costs for each U.S. state under the new T86 policy and reprice their products accordingly. If the new prices remain acceptable to their target audience, they may continue with the current product line; if not, they will need to pivot decisively. This change is expected to raise the barrier to entry, phasing out many small sellers who once thrived on the fragmented, low-cost model, while larger, better-funded, and branded sellers stand to gain more market share.

U.S. Adjusted Tariff Rates by Country/Region

| Country/Region | Tariff after U.S. Adjustment (%) |

|---|---|

| China | 34% |

| European Union | 20% |

| Vietnam | 46% |

| Taiwan (China) | 32% |

| Japan | 24% |

| India | 26% |

| South Korea | 25% |

| Thailand | 36% |

| Switzerland | 31% |

| Indonesia | 32% |

| Malaysia | 24% |

| Cambodia | 49% |

| United Kingdom | 10% |

| South Africa | 30% |

| Brazil | 10% |

| Singapore | 10% |

| Israel | 17% |

| Philippines | 17% |

| Chile | 10% |

| Australia | 10% |

| Pakistan | 29% |

| Turkey | 10% |

| Sri Lanka | 44% |

| Colombia | 10% |

| Peru | 10% |

| Nicaragua | 18% |

| Hungary | 15% |

| Costa Rica | 10% |

| Jordan | 20% |

| Dominican Republic | 10% |

| United Arab Emirates | 10% |

| New Zealand | 10% |

| Argentina | 10% |

| Guatemala | 10% |

| Honduras | 10% |

| Madagascar | 47% |

| Myanmar (Burma) | 44% |

| Tunisia | 28% |

| Kazakhstan | 27% |

| North Macedonia | 37% |

| Egypt | 10% |

| Saudi Arabia | 10% |

| Slovakia | 10% |

| Laos | 48% |

| Botswana | 37% |

| Trinidad and Tobago | 10% |

| Morocco | 10% |

Overall, the cross-border e-commerce industry is predicted to undergo a cycle of “rising costs → business model transformation → market clearing,” shifting from a broad “low-price, high-volume” approach to a more refined model that emphasizes capital investment and brand strength.

I wonder how many small sellers will survive this tariff storm. It’s going to be rough.

Local warehouses in the US? Looks like it’s time for a serious logistics upgrade.

Wow, this is a game changer—no more sneaky small packages to dodge tariffs!

The new tariffs on China, Japan, and Vietnam are just adding fuel to the fire.

The end of the de minimis era means it’s time to rethink your cross-border business strategy.

Anyone else feeling like Trump’s back with a vengeance on trade?

The shift to T11/T01 clearance sounds like it could seriously slow down shipping times.

If you’re in this game, start recalculating those costs now. No more freebies.

Cross-border e-commerce is about to get a lot more expensive—and complicated.

Bigger brands are going to dominate while the little guys struggle with these changes.