How USA Small Appliances Are Outpacing Big Appliances and Capturing Global Markets

I. A Dark Horse in an Industry in Decline

USA small appliances posted a compound annual growth rate of 12.5% from 2003 to 2007 – emerging as the dark horse amid overall declines in large appliances. According to data from Qianzhan Industry Research Institute, the market scale for small appliances grew from 167.3 billion RMB in 2012 to 401.5 billion RMB in 2019, reflecting an annual compound growth rate of 13.3%. Compared to the slow iterative improvements in major appliances, small appliances remain nimble and agile.

II. TikTok: The New Darling in Small Appliance & Kitchen Gadgets

Within discussions about electric ovens on TikTok, the word “mini” is frequently mentioned – highlighting the trend toward miniaturization and compact designs that have become popular recently. In the U.S. market segment for kitchen appliances on TikTok Shop, one pizza oven’s sales shot up by 99.6% compared to last week. With a sales revenue of US$424,000 and a historical total of US$987,800, a video posted on March 11 that garnered over 10.54 million views spurred considerable consumer interest.

III. Amazon’s Dominance: Vesync Leads the Small Appliance Charge

In the realm of small appliances, the market is enormous. From October 2022 to September 2023, sales on major e-commerce platforms for small appliances reached 130.72 billion RMB, with top brands capturing around 37.1% market share. Recently, Vesync – a leading small appliance seller on Amazon – released its annual report ending December 31, 2023. The report reveals that Vesync, after its successful listing on the Hong Kong Stock Exchange in 2020, has finally reversed its losses and turned profitable in 2023. Vesync achieved US$586 million in revenue (equivalent to 4.2 billion RMB), a year-over-year increase of 19.4%, and posted a gross profit of approximately US$274 million (19.8 billion RMB), marking a 92.8% increase from 2022. On Amazon, a simple search reveals Vesync small appliances dominating the No.1 spot—with many products achieving monthly sales of over 50,000 units.

IV. Levoit and the Rise of Youthful Small Appliance Brands

Levoit has become a favorite small appliance brand among younger consumers. It is well-regarded for its aesthetically pleasing designs and compact, fresh style that resonate with modern tastes, earning high consumer approval. As the small appliances market continues to develop, smart functionality will soon be a key trend. Devices that offer more modern, tech-savvy features and integrate seamlessly into smart home ecosystems are poised to become the next big hits.

V. Bear Electric: A Rising Star in 2023

Even as the global economy faced turbulence in 2022 due to inflation and declining consumer demand, the small appliance market began recovering in 2023—propelled by the rapid rise of the “stay-at-home economy.” Bear Electric, founded in 2006, quickly emerged as a force in the kitchen appliance segment by leveraging creative products and efficient channels. Despite pandemic-induced slumps in kitchen tool sales, its multi-category strategy and focus on long-tail products enabled Bear Electric to stand out once again. In the first half of 2023, its overseas sales reached 136 million RMB—a year-over-year jump of 102.37%. Bear Electric’s annual revenue for 2023 was 4.7 billion RMB, a growth of 14.22% compared to the previous year. For the small appliances category—characterized by low prices, rapid iteration, and a vast array of options—Bear Electric perfectly encapsulates all these advantages, combining quality with the ability to meet consumers’ unique, situational, and emotional needs to make individual products a breakout hit.

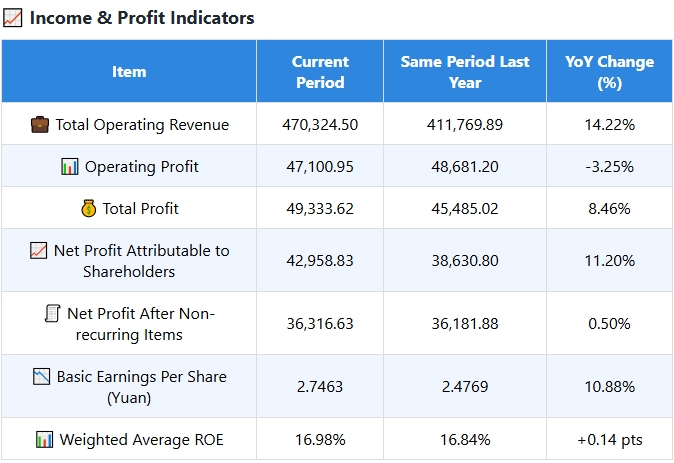

📋 2023 Annual Key Financial Data and Indicators

Unit: 10,000 RMB

| Item | Current Period | Same Period Last Year | YoY Change (%) |

|---|---|---|---|

| 💼 Total Operating Revenue | 470,324.50 | 411,769.89 | 14.22% |

| 📊 Operating Profit | 47,100.95 | 48,681.20 | -3.25% |

| 💰 Total Profit | 49,333.62 | 45,485.02 | 8.46% |

| 📈 Net Profit Attributable to Shareholders | 42,958.83 | 38,630.80 | 11.20% |

| 🧾 Net Profit After Non-recurring Items | 36,316.63 | 36,181.88 | 0.50% |

| 📉 Basic Earnings Per Share (Yuan) | 2.7463 | 2.4769 | 10.88% |

| 📊 Weighted Average ROE | 16.98% | 16.84% | +0.14 pts |

| Item | End of Reporting Period | Beginning of Reporting Period | Change (%) |

|---|---|---|---|

| 📦 Total Assets | 545,571.57 | 487,276.21 | 11.96% |

| 📘 Shareholders’ Equity | 401,175.77 | 349,006.96 | 14.96% |

| 👥 Share Capital | 15,684.55 | 15,684.55 | 0.00% |

| 🔐 Net Assets Per Share (Yuan) | 25.57 | 22.25 | 14.94% |

Note: The data in this table is based on consolidated financial statements. Minor discrepancies may exist due to rounding.

VI. Roborock: Leading the Smart Revolution in Floor Cleaning

The rise of the “lazy economy” has given a powerful boost to small appliances. Smart products that free up consumers’ hands have become irresistibly attractive. Recently, financial reports from Roborock—the brand under Stone Technology specializing in robotic vacuum cleaners—revealed 2023 revenues of approximately 8.65 billion RMB, up 30.55% year-over-year. As of December 31, 2023, its total assets were 14.38 billion RMB, up 32.71% from the beginning of the year, with a net profit attributable to shareholders of 2.05 billion RMB—a 73.32% increase. On Amazon, Roborock products rank in the TOP 10 with two models achieving over 10,000 monthly sales combined. Roborock’s advanced robotic vacuums focus on eliminating missed spots and redundant cleaning, greatly enhancing the user experience in multiple scenarios. Constant product updates and iterations, in sync with the pace of technology, have made it a favorite among influencers and everyday users alike.

📊 Key Financial Data and Indicators Over the Past 3 Years

Unit: Yuan Currency: RMB

| Indicator | 2023 | 2022 | YoY Change (%) | 2021 |

|---|---|---|---|---|

| 💼 Total Assets | 14,376,641,614 | 10,833,053,890 | 32.71 | 9,807,393,894 |

| 🏢 Net Assets Attributable to Shareholders | 11,380,526,122 | 9,556,378,416 | 19.07 | 8,491,558,784 |

| 📈 Operating Revenue | 8,653,783,788 | 6,627,716,402 | 30.55 | 5,080,225,226 |

| 💰 Net Profit Attributable to Shareholders | 2,051,217,414 | 1,426,946,012 | 43.82 | 1,402,476,092 |

| 💸 Net Profit After Non-recurring Items | 1,826,089,668 | 1,197,719,439 | 52.46 | 1,142,099,154 |

| 💵 Net Cash Flow from Operating Activities | 2,185,931,368 | 2,160,467,567 | 1.18 | 1,518,872,092 |

| 📊 Weighted Average Return on Equity (%) | 19.56 | 19.16 | +0.40 percentage points | 18.00 |

| 💵 Basic Earnings Per Share (Yuan) | 1.65 | 0.95 | 73.23 | 1.73 |

| 💹 Diluted Earnings Per Share (Yuan) | 1.58 | 0.91 | 72.42 | 1.66 |

| 🧪 R&D Expenses as % of Revenue | 7.15 | 7.37 | -0.22 percentage points | 7.55 |

Conclusion

The small appliances market is vast and dynamic. With low price points, fast iteration cycles, and a myriad of product types, these devices are primed to become breakout successes. For those looking to enter this space, there remains a substantial opportunity to achieve rapid success—as long as they can hone in on consumer preferences, build technological barriers, and enhance product quality.

The small appliances market is booming—moving from sluggish big appliances to nimble, innovative devices is a real game-changer.

From TikTok mini-trends to Amazon’s top sellers, it’s clear that the future of home appliances is both smart and compact.

I love the trend of integrating smart features into small appliances—it’s like a mini tech revolution!

Who knew that even in a declining big appliance market, small appliances could emerge as the dark horse?

Bear Electric’s jump in overseas sales by over 100% is proof that innovation and diversification really pay off.

Vesync’s impressive revenue turnaround on Amazon proves that smart small appliances can turn losses into profits.

The small appliance industry is a prime example of how rapid iteration and low prices can create explosive market growth.

I’m blown away by how miniaturization trends on TikTok are reshaping products like electric ovens.

Roborock’s focus on solving missed spots and improving user experience makes it a must-have in any smart home.

Bear Electric’s multi-category strategy and soaring overseas sales show that adaptability truly pays off.

Roborock’s numbers are insane! Smart vacuums are clearly riding the wave of the ‘lazy economy’.

It’s fascinating to see a niche market like small appliances growing at over 13% CAGR in recent years.