Fiscal Year 2023 Performance

Amazon reported total revenue of $574.8 billion for the fiscal year 2023, with a net profit of $30.4 billion and free cash flow of $32.2 billion. However, beyond revenue and profit, two key figures are even more critical for Amazon’s continued growth: fulfillment costs of $90.6 billion and R&D and content expenditures of $85.6 billion. This massive investment makes Amazon the global leader in research and development spending.

From a total revenue perspective, Amazon is on track to surpass Walmart in a few years, becoming the world’s largest company by revenue. However, this comparison is slightly misleading as Amazon operates in more business segments than Walmart. In 2023, Amazon’s revenue breakdown was as follows:

- Shopping revenue: $391.9 billion

- Advertising revenue: $46.9 billion

- Subscription services: $40.2 billion

- AWS cloud services: $90.6 billion

- Other: $5 billion

While Amazon’s total revenue is nearing Walmart’s $648.1 billion, its core shopping revenue still lags by nearly half. This highlights that Amazon, despite its dominance, has not fully replaced offline retail experiences. However, Amazon’s rising gross margin suggests a strong long-term growth trajectory. Meanwhile, China’s cross-border e-commerce companies, often referred to as the “Four Little Dragons,” have shown aggressive expansion. The rumored upcoming IPO of SHEIN further intensifies global competition. While Amazon remains the undisputed leader in the U.S. market, it faces increasing challenges from competitors. One certainty is that the U.S. government will attempt to curb the expansion of Chinese companies like SHEIN, which currently has an estimated valuation between $60 billion and $90 billion.

Q1 2024 Performance

For the first quarter of 2024, Amazon reported:

- Revenue: $143.3 billion

- Net profit: $10.4 billion

- Gross margin: 49%

- Free cash flow: $4.1 billion

Summary

Amazon continued its year-over-year growth trajectory in Q1 2024, with rising profitability and strong cash flow.

The Core of Amazon: Long-Term Vision

Amazon is the world’s top R&D spender, a testament to its commitment to long-term strategy. Understanding a company’s operations requires analyzing its fundamental business philosophy. For example, what can we learn from Amazon? A review of all Amazon annual reports since 1997 reveals that the company, once branding itself as the “Earth’s Biggest Bookstore,” has indeed become the largest global retailer.

Amazon’s 1997 Annual Report Highlights

“Since opening for business as the ‘Earth’s Biggest Bookstore’ in July 1995, Amazon.com has become one of the most widely known, used, and cited commerce sites on the World Wide Web. Amazon.com strives to offer its customers compelling value through innovative use of technology, broad selection, high-quality content, a high level of customer service, competitive pricing, and personalized services.”

Even after 27 years, Amazon has remained steadfast in its core principles:

- Be the world’s largest online retailer

- Provide value to customers

- Leverage technology

- Offer a wide selection

- Deliver high-quality content

- Maintain excellent customer service

- Ensure competitive pricing

- Personalize services

These principles persist across Amazon’s financial reports, reflected in expenses like fulfillment and R&D costs. However, Amazon’s long-term dedication to these values is best captured in Jeff Bezos’ annual letters to shareholders. His recurring message has been: “It’s All About the Long Term.”

Financial Indicators of Market Leadership

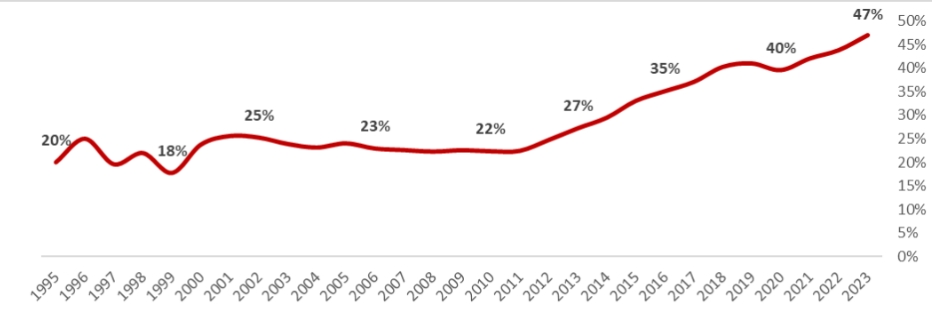

Amazon’s long-term success can be measured by its continuous revenue growth, increasing gross margins, consistent reinvestment (e.g., rising fulfillment and R&D costs), and growing return on equity (ROE). A comparison of Amazon’s financials from 1997 to the present makes these trends clear, particularly in revenue and gross margin expansion.

Beyond financials, other key market leadership indicators include:

- User growth

- Customer retention and repurchase rates

- Brand recognition

- Customer base expansion

- Infrastructure investments

Even decades later, these remain crucial for any business striving for longevity and success.

Amazon’s Investment Philosophy

Amazon prioritizes cash flow over net profit, emphasizing sustainable growth and reinvestment. This philosophy is evident in its annual free cash flow figures. Since 2000, even when Amazon reported net losses, it maintained positive and growing cash flow. The only exception was during the COVID-19 pandemic when cash flow turned negative for two years before rebounding in 2023. This relentless focus on positive cash flow is central to Amazon’s business model.

Infrastructure Investments

Amazon’s infrastructure investments serve three main purposes:

- Traffic acquisition

- Revenue generation

- Customer service

Similar to platforms like Taobao and JD.com, these factors define success in the internet business era. From traffic acquisition and marketing to conversion, delivery, customer service, and repeat purchases, the ability to maximize customer satisfaction determines a company’s growth. Even today, these fundamentals remain unchanged.

Amazon’s Financial Strategy

A simplified look at Amazon’s financials reveals that its primary assets are fixed assets, mainly:

- Warehouses

- Distribution centers

- Logistics hubs

- Service centers

- Data centers

These fulfillment centers ensure smooth product delivery. While JD.com has successfully replicated Amazon’s logistics model, Walmart was actually the pioneer in this space. As early as the 1970s, Walmart began developing computer-driven logistics systems, as detailed in Sam Walton’s autobiography.

Capital Reinvestment Model

In 2023, Amazon’s:

- Gross margin was 47%

- Net profit margin was 5%

So where did the rest of the money go?

- Fulfillment costs: $90.6 billion (16% of revenue)

- Technology and content development: $85.6 billion (15% of revenue)

Amazon maintains strong cash flow but reinvests heavily in fulfillment and technology. This aligns with its founding principles from 1997: delight customers and embrace technology.

Amazon historically avoids dividends and stock buybacks, with total share repurchases amounting to just $8 billion. Instead, it generates long-term value for shareholders by reinvesting cash flow into customer experience and technology, reinforcing its leadership position. This strategy has fueled Amazon’s astronomical valuation growth.

Conclusion

Amazon’s success is built on long-term vision, continuous reinvestment, and customer-centric innovation. By prioritizing fulfillment, technology, and customer satisfaction, Amazon has cemented its market dominance while adapting to evolving competitive landscapes. As global e-commerce continues to shift, Amazon’s ability to maintain its leadership position will depend on its commitment to these principles.