Overview of Amazon’s Macro Data

1. Traffic Data

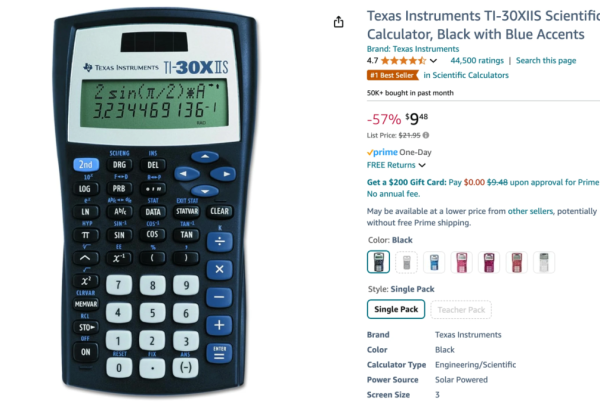

- In July 2023, Amazon’s global website traffic reached 2.79 billion visits, up from 2.5 billion in June 2023, reflecting a 10.6% year-over-year increase.

- Over the past six months, Amazon saw the highest number of global visits from mobile devices, reaching 1.2 billion (55.6% of total traffic), while desktop visits accounted for 1.5 billion (44.4%).

- The United States remains Amazon’s largest traffic source, followed by India and Canada.

- By 2024, Amazon’s traffic is expected to surpass Walmart’s, making it the leader in the U.S. market.

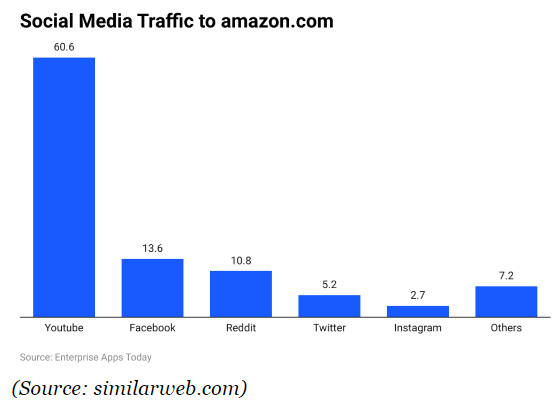

Social Media Traffic Sources

- The top three social media traffic sources directing visitors to Amazon are:

- YouTube (59.64%)

- Facebook (14.80%)

- Reddit (9.61%)

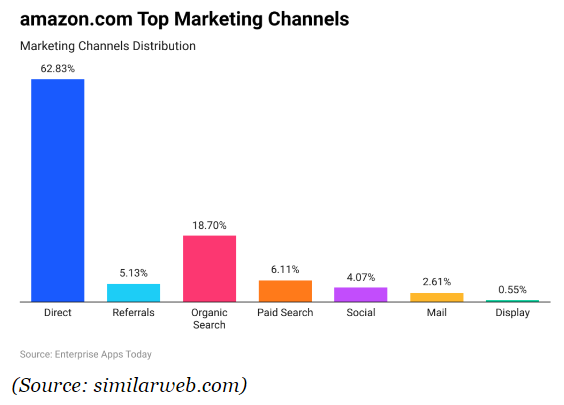

- Amazon’s traffic distribution breakdown:

- Direct traffic: 62.83%

- Organic search: 18.70%

- Paid search: 6.11%

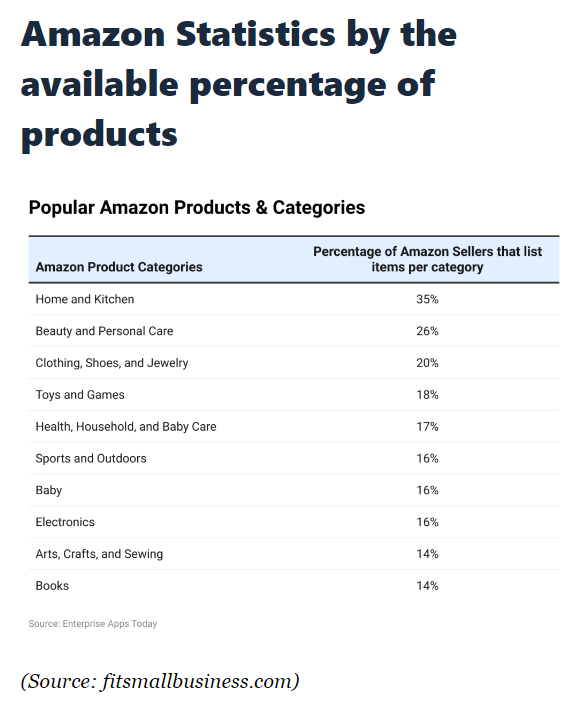

2. Product Category Data

- As of 2023, the top three product categories with the widest supply range are:

- Home & Kitchen (35%)

- Beauty & Personal Care (26%)

- Apparel, Shoes & Jewelry (20%)

- Categories with fewer products include:

- Electronics (16%)

- Arts, Crafts & Sewing (14%)

- As of March 2023, Amazon was recognized as one of the world’s most valuable e-commerce brands. Amazon holds over 90% market share in several product categories, including:

- Skincare (91%)

- Golf-related products (92%)

- Home improvement tools (93%)

- Kitchen & dining products (94%)

- Batteries (97%)

Brand, Seller, and Consumer Behavior Statistics

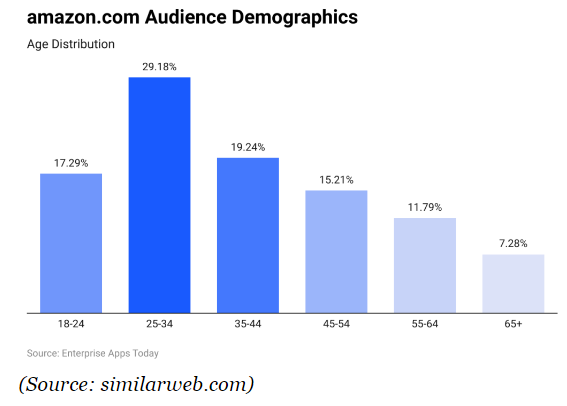

1. Consumer Demographics

- The largest age group of Amazon consumers falls between 25 and 34 years old (29.18%). Other key age groups include:

- 35 to 44 years old: 19.24%

- 18 to 24 years old: 17.29%

- 65+ years old: 7.28%

- The most preferred shopping categories among consumers include:

- Home & Kitchen

- Office Supplies

- Apparel

- Electronics

- Beauty & Personal Care

- Automotive Parts

- These categories collectively make up 23% of consumer preferences.

2. Consumer Behavior Data

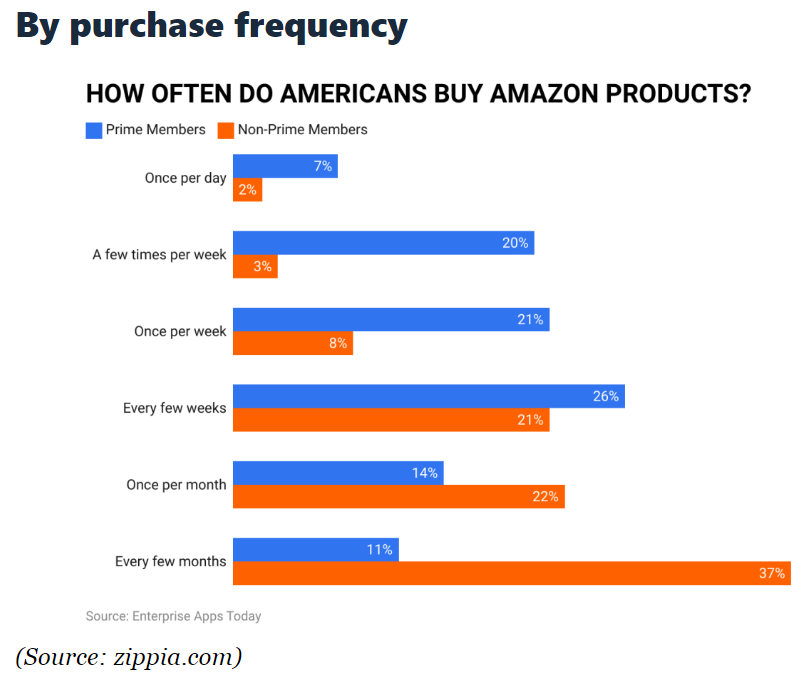

- In the U.S. market, Amazon Prime membership has surpassed 172 million users.

- In Q1 2023, approximately 26 million consumers opted for same-day delivery, a 50% increase from the previous year.

- Pre-purchase behavior:

- 90% of consumers check Amazon for price comparisons before purchasing a new brand.

- 50% of consumers are willing to purchase unknown brands from Amazon.

- Brand preferences:

- 76% of consumers are more likely to purchase private-label brands available on Amazon.

- 38% of consumers find search ads helpful.

- Conversion & shopping preferences:

- Amazon’s average order conversion rate ranges from 12% to 13%.

- 89% of online shoppers prefer Amazon over other e-commerce websites.

- 66% of consumers favor Amazon because they can find everything they need on one platform.

- 90% of consumers are satisfied with Amazon’s customer service.

3. Seller & Brand Data

- The majority of Amazon’s third-party sellers are based in:

- United States (68.9%)

- China (27.0%)

- Hong Kong (2.1%)

- Amazon processes a high volume of orders daily:

- One order is shipped every 18.5 seconds.

- 66,000 orders are shipped per hour.

- 1.6 million orders are shipped per day.

- Fulfillment & advertising:

- In 2022, 64% of sellers used Fulfillment by Amazon (FBA).

- 59% of brands spent over $60,000 per month on Amazon advertising.

- Cross-platform selling:

- 80% of Amazon sellers also sell on other e-commerce platforms.

- Amazon has over 6.4 million registered sellers worldwide, with 1.5 million active sellers.

- An average of 3,700 new sellers register on Amazon daily.

- Prime & revenue distribution:

- 83% of Amazon sellers use Prime shipping.

- Monthly revenue breakdown:

- 27% of sellers earn between $1,000 and $5,000 per month.

- 22% of sellers earn below $500 per month.

- Only 1% of sellers report monthly earnings between $100,000 and $250,000.