Expanding Markets and Bold Strategies in 2023

Temu has been on fire in 2023, relentlessly expanding its overseas market. So far, it has reached 37 countries and regions. Its innovative “fully managed” supply chain model on online platforms has sparked eager attempts from other major platforms.

This year, Amazon has implemented a series of new measures to retain users:

• Increasing the benefits for new sellers joining the platform, ensuring a continuous influx of fresh talent;

• Lowering logistics fees for existing sellers of low-priced items to reduce customer loss on budget products;

• Broadening new buyer traffic channels to compensate for disappearing user segments;

• Offering large-scale discount subsidies to boost repurchase rates among both new and loyal customers.

────────────────────────────

PART.01 – The Amazon Contender

1. Record-Low Logistics Rates for Low-Priced Items

Since August 29, 2023, Amazon Logistics in the United States has rolled out a new, lower fee rate for all items priced under US $10. The new rate saves each seller an average of $0.77 per item compared to the standard rate for items of similar size and weight.

For sellers, this means significantly reduced logistics costs and enhanced sales opportunities. Buyers also benefit from more choices and a faster delivery experience.

📦 Shipping & Packaging Fees Overview

(Dimension unit conversion: 1 inch ≈ 2.54 cm; below figures for reference only)

| Packaging Category | Dimensions (Inches / cm) |

Fee (USD) |

|---|---|---|

| Small Envelope | 9″ × 12″ (22.9 × 30.5 cm) |

$3.22 |

| Medium Envelope | 10″ × 13″ (25.4 × 33 cm) |

$3.45 |

| Large Envelope | 12″ × 15″ (30.5 × 38.1 cm) |

$3.89 |

| Small Box | up to 8″ × 8″ × 8″ (20.3 × 20.3 × 20.3 cm) |

$4.12 |

| Weight Range | Courier Fee (RMB, Excl. Fuel) |

Additional Remarks |

|---|---|---|

| 0 – 1 kg | ¥25.00 | Base rate, tracked shipping |

| 1 – 3 kg | ¥38.00 | +¥8 per additional kg over 2 kg |

| 3 – 5 kg | ¥52.00 | +¥7 per additional kg over 4 kg |

| Parcel Size | Fee (USD) | Notes |

|---|---|---|

| Large Consolidated Package (e.g., 18″ × 18″ × 12″) |

$8.60 | Suited for combined shipments |

| Oversized Package (Above 150 cm total girth) |

$10.50 | Special handling required |

* The data above is for illustration only. Please update the actual rates, dimensions, and fees based on your screenshot or internal system.

(Data source: Amazon backend)

2. Launch of Buyer Interaction Discount Emails

Now supporting the “Percentage Off” type of promotion, brand sellers can create promotions that send customized emails with discount codes ranging from 15% to 50% to their fans via the new MYCE email tool.

For sellers, this tool enables targeted reminders to brand fans—pushing a discount email to the same customer once every 7 days. This not only boosts campaign effectiveness and deepens brand–fan relationships, but also increases customer stickiness and stimulates further consumption.

For buyers, receiving such emails makes them feel valued by the brand and lets them purchase quality products at attractive prices.

3. Increased Slots for Amazon Outlet Flash Sales

Since July, Amazon Outlet flash sale slots have gradually increased, inviting more ASINs to join the limited-time promotions with an expected recommendation increase of over 70%.

For sellers, Amazon Outlet promotions offer an extra, zero-cost traffic channel, helping clear surplus inventory without incurring additional storage fees.

For buyers, these promotions feature a wide range of categories and affordable prices, satisfying the demand for low-cost products.

These promotions not only save sellers’ operational time but also free up Amazon’s inventory space, maximizing the recovery of inventory value and keeping overall stock operations healthier.

(Image source: Amazon)

4. Brand-Customized Exclusive Promotion Discount Tools

Many sellers’ product pages have recently been marked with “Follower promotion” and “Exclusive promotion.”

This is Amazon’s new brand-customized promotion tool, allowing creation of exclusive discount offers (ranging from 10% to 50%) via promotion codes. It targets brand fans, repeat customers, recent buyers, high-spending customers, and even customers with pending payments, while also tapping into the “potential new customer” segment.

For sellers, it means tailoring promotions for different customer groups to boost transaction opportunities.

For buyers, it provides more discount options to purchase premium products at the lowest possible prices.

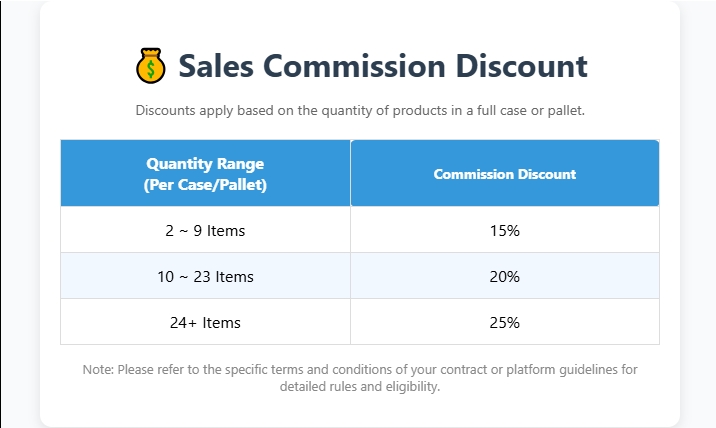

5. Up to 25% Commission Reduction for Enterprise Bulk Sales

To address the business procurement needs of enterprise buyers and operational challenges of sellers, Amazon has launched a bulk sales service with multi-level packaging display and large-package recommendations.

For qualifying large-package items, sellers can receive a 15%–25% commission discount, with consolidated shipping available—greatly lowering per-item costs.

This saves buyers on large-scale purchases and increases sellers’ sales and profits.

💰 Sales Commission Discount

Discounts apply based on the quantity of products in a full case or pallet.

| Quantity Range (Per Case/Pallet) |

Commission Discount |

|---|---|

| 2 ~ 9 Items | 15% |

| 10 ~ 23 Items | 20% |

| 24+ Items | 25% |

Note: Please refer to the specific terms and conditions of your contract or platform guidelines for detailed rules and eligibility.

(Data source: Amazon)

6. Attractive Benefits for Sellers Onboarded from March 2023

For new sellers joining on or after March 1, 2023:

• When a new buyer purchases their first available ASIN, 5% of the first-year or first US $1 million brand merchandise sales will be rebated, with a maximum of US $50,000 per site and up to US $150,000 in total across sites.

• Sellers who register for the Vine program within 90 days after brand registration (or after the launch of their first ASIN, whichever is later) receive a US $200 Vine program credit.

• New sellers who register for Amazon FBA are eligible for up to US $200 off inbound shipping fees, plus limited-time free storage, removal, and return processing for new ASINs.

• Additionally, creating an ad campaign within the first 90 days of launching an ASIN earns a US $50 ad credit, and launching Amazon coupons within the same period gets a US $50 coupon fee discount.

7. Challenges Confronting Amazon

With emerging competitor platforms rapidly growing, Amazon’s long-held dominance is under threat.

In addition to multiple warehouse worker strikes adding unprecedented burdens, since the beginning of this year, Amazon in the UK has seen over a million daily mobile app users lost, further impacting its performance.

Beyond the popular Temu, SHEIN also exerts considerable pressure—its mobile users have doubled from 1 million to 2 million in the past six months. Additionally, European second-hand platform Vinted continues its stable growth, with nearly 2 million daily active users.

Amazon’s “big cake” that it has dominated for years is now being sliced by Temu, SHEIN, TikTok, AliExpress, Lazada, and others. With users fleeing, how can Amazon maintain its position?

────────────────────────────

PART.02 – The Temu Contender

1. Unstoppable Global Expansion

Recently, Pinduoduo’s cross-border e-commerce platform Temu officially launched its Chile and Philippines sites, accelerating its global expansion. The Philippines marks its first Southeast Asian site, while Chile signals Temu’s entry into the farthest South American market from China.

Since its launch in September last year, Temu has entered 37 countries and regions. In August, its major expansion efforts focused on Europe, Southeast Asia, and South America.

These include Australia, Austria, Belgium, Bulgaria, Canada, Chile, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Latvia, Lithuania, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Philippines, Poland, Portugal, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, United Kingdom, and the United States.

Temu’s new site promotions continue its low-price strategy by offering large-value coupons, discount activities, and free shipping.

2. APP Ranking Breakthrough

Temu’s rapid development is remarkable—it has stabilized its position overseas in less than a year.

Recent data from Sensor Tower on Q2 2023 indicates that Temu has entered the global top 10 in downloads for the first time.

This proves its popularity overseas and signals that it has become a major contender in the global app market.

Temu’s success is largely attributed to its strategy of expanding in the European market. In Q2, its installations increased more than twofold, from 31 million to 74 million.

Its rising popularity is solidifying its position as an influential global app.

3. Disrupting the Traditional Model

With a “wild growth” gene, Temu is not only sweeping across global markets like a tiger but also disrupting traditional models.

After launching its US site, Temu introduced a “fully managed” mode.

For sellers, this mode saves the cost of establishing their own warehousing, logistics, and customs clearance, while also reducing labor and time costs and improving operational efficiency and risk control.

For the platform, controlling the core e-commerce processes in-house is highly beneficial for future development.

For buyers, it translates into superior pre-sale, in-sale, and after-sale services.

Following Temu’s lead, AliExpress, Shopee, Lazada, TikTok, and others have announced trials of fully managed models; even the e-commerce giant Amazon is reportedly testing its own fully managed mode, expected to be launched by the end of the year.

4. Temu’s Challenges

Temu operates under two modes: JIT (Just-In-Time, or pre-sale) and VMI (Vendor Managed Inventory, essentially stocking). Most sellers choose the latter.

Temu has pulled out all stops in driving traffic and expanding its market, and both the platform and its sellers have seen soaring orders.

However, despite rapid front-end expansion and an ever-growing overseas footprint, the back-end warehousing and logistics still lag behind, resulting in serious inventory pile-ups. Orders—both first-time and repeat—as well as hot products are now being halted from entering the warehouse.

The fully managed “low margin, high volume” model is exactly what Pinduoduo excels at; however, it also tests the platform’s warehousing management, logistics, and resource integration capabilities—a process that Temu still appears to be ironing out.

Will Temu continue to forge ahead with effective strategies and ultimately become the “Amazon killer”?

The coming battle between these giants could redefine e-commerce globally.

Temu’s low-price and fully managed model is shaking up traditional e-commerce norms.

Amazon’s innovative new seller benefits could reshape the market landscape.

Temu’s relentless global expansion proves they mean business.

Temu’s disruptive approach forces rivals to rethink their strategies.

Amazon’s strategy to fight emerging competitors shows a shift in market dynamics.

Despite huge expansion, Temu still faces challenges in logistics and inventory management.

New seller incentives are stacked to help boost initial sales and engagement.

Record-low logistics fees for items under $10 might just be a game-changer.

Amazon and Temu are both innovating fiercely to capture market share.

Rapid app downloads indicate Temu is quickly becoming a global hit.